Metaplanet Adds 518 BTC, Total Bitcoin Reserves Cross 18,000 Mark

Metaplanet , a publicly traded Japanese investment firm listed on the Tokyo Stock Exchange, has deepened its bet on Bitcoin with the purchase of an additional 518 BTC , lifting its total holdings to 18,113 BTC ($2.1b). The company, which pivoted from hotel management to digital assets under CEO Simon Gerovich in 2024, has emerged as one of Asia’s most aggressive corporate Bitcoin accumulators. Gerovich, a former Goldman Sachs derivatives trader, has steered the firm toward a bold treasury strategy modeled after MicroStrategy’s playbook. Metaplanet’s “ 555 Million Plan ” aims to amass 210,000 BTC, around 1% of the total Bitcoin supply, by the end of 2027. This is a substantial upgrade from its earlier “21 Million Plan,” which targeted 21,000 BTC by 2026. Metaplanet Acquires Additional 518 $BTC , Total Holdings Reach 18,113 BTC pic.twitter.com/rKT2l2oTRj — Metaplanet Inc. (@Metaplanet_JP) August 12, 2025 Metaplanet Taps Innovative Financing Tools to Fuel Bitcoin Push To finance this expansion, the company has relied on unconventional funding methods such as zero-interest bonds, moving-strike warrants and perpetual preferred stock issuances. The latest acquisition followed an Aug. 1 filing for a shelf registration to raise up to 555b yen (about $3.74b) through perpetual preferred shares. In the same proposal, Metaplanet sought to increase its authorized share count to 2.72b and introduce two classes of perpetual preferred shares, each with distinct risk and conversion features. The move, the company said, is designed to align financing flexibility with investor preferences. Zero-Interest Bonds, Warrants and Preferred Shares Drive BTC Buys Metaplanet’s earlier fundraising efforts have also been substantial. It issued 270.36b yen (about $1.82b) in zero-interest convertible bonds and secured 9.09b yen (about $61.25m) through moving-strike warrants. The firm additionally raised 12.75b yen (about $85.91m) by issuing perpetual preferred shares to strategic investors. The company has also executed smaller tactical financings, such as a 14.93m yen (about $100,600) share issuance and a 17.54m yen (about $118,200) preferred stock sale. These, while modest in size, have contributed to maintaining its steady buying pace. Metaplanet’s strategy is predicated on the belief that Bitcoin will continue to appreciate over the long term, serving both as a store of value and a hedge against currency depreciation. The company’s aggressive acquisition schedule has already made it the largest corporate Bitcoin holder in Asia. Plan Puts Firm Among World’s Largest Institutional Bitcoin Buyers Analysts note that the scale of the plan puts Metaplanet in the same league as the biggest institutional Bitcoin buyers worldwide. This signals a growing mainstream acceptance of Bitcoin as a corporate treasury asset. However, the size of its financing program also raises concerns. The concentration in a single, volatile asset carries risk, especially if market conditions shift. Gerovich has maintained that the approach is calculated. He says each financing instrument is designed to optimize shareholder value while advancing the BTC target. Further, the firm continues to see strong investor appetite for its preferred shares and convertible bonds. This, he believes, is evidence of market confidence in its vision. If Metaplanet meets its 210,000 BTC goal by 2027, it will reshape its balance sheet and cement its position as one of the most influential corporate players in the cryptocurrency sector. The post Metaplanet Adds 518 BTC, Total Bitcoin Reserves Cross 18,000 Mark appeared first on Cryptonews .

cryptonewsabout 3 hours ago

cryptonewsabout 3 hours ago

Dogecoin (DOGE) Jumps on $200M Whale Buys — PEPE & FLOKI Surge as New Meme Coin Rockets 700% in Just Days

The crypto market has been buzzing this week after Dogecoin made a sharp move higher. Trading records show that major holders—often called whales—purchased more than $200 million worth of DOGE in just one day. Such heavy buying has pulled in fresh interest from both retail traders and larger institutions. Analysts say the surge in demand could be the start of a broader rebound in the meme coin market. Whales Drive DOGE’s Price Higher Dogecoin’s jump came as a handful of large investors increased their positions significantly. Moves like this often send a signal of confidence, which can attract more buyers into the market. Some traders are now watching closely for any regulatory developments, particularly talk of a possible U.S. spot DOGE ETF. If such a product were approved, analysts believe institutional demand could rise sharply. PEPE and FLOKI Ride the Momentum The rally in DOGE has spilled over into other well-known meme coins. PEPE and FLOKI have both posted notable gains in recent days. The two coins have experienced rising trading volumes alongside social media activity. The simultaneous climb suggests a renewed appetite for meme tokens. In addition, it highlights the close link between sentiment-driven assets in this sector. MAGACOIN FINANCE Draws Investor Interest Outside the spotlight of the major names, MAGACOIN FINANCE has been gathering traction slowly but surely. The project has undergone multiple independent audits, making it more secure in terms of its profile than most new tokens are. Its team has been active in engaging with the community, sharing updates, and maintaining transparency—a factor that has helped its supporter base grow quickly. The presale is progressing at a very fast rate, with initial investors citing the prospects of growth along with the strength of security as factors that prompted them to take part. Future Market Outlook The latest wave of whale purchases demonstrates that the trust in the meme coin segment is not lost yet. DOGE, PEPE, and FLOKI are all riding the new wave of growth, whereas MAGACOIN FINANCE is a new coin with a secure background and an emerging community. Regulatory developments, such as ETF approvals, are also being closely monitored by investors who believe they may become a key factor in determining future market demand in the coming months. To learn more about MAGACOIN FINANCE, visit: Website: https://magacoinfinance.com Access: https://magacoinfinance.com/access X: https://x.com/magacoinfinance Telegram: https://t.me/magacoinfinance Continue Reading: Dogecoin (DOGE) Jumps on $200M Whale Buys — PEPE & FLOKI Surge as New Meme Coin Rockets 700% in Just Days

bitcoinsistemiabout 4 hours ago

bitcoinsistemiabout 4 hours ago

Malaysia Central Bank Paper Sparks Debate by Naming XRP and BTC as Monetary Alternatives

A recent working paper from the Central Bank of Malaysia has identified XRP and bitcoin as potential alternatives to traditional monetary and payment systems. Digital Assets Could Replace Bank Deposits A recent working paper from the Central Bank of Malaysia (CBM) has identified XRP alongside bitcoin ( BTC) as potential “alternatives to the current monetary

bitcoin.comabout 4 hours ago

bitcoin.comabout 4 hours ago

Cardano Price Prediction: ADA Testing Holders Patience As Remittix’s $20M CEX Milestone Steals Headlines

The Cardano price prediction is heating up as ADA tests a major resistance zone after recent gains. Traders are watching closely for signs of a sustained breakout, while excitement in the broader market shifts toward Remittix (RTX) . The project is now just over $1 million away from reaching its $20 million target, which will trigger the reveal of its first centralized exchange listing. With $18.9 million raised from the sale of over 591 million tokens at $0.0922 each, Remittix is being positioned as one of the best crypto projects 2025. Cardano Price Prediction Points to Breakout Source: Ali Martinez The latest Cardano price prediction is supported by a bullish triangle breakout , with ADA up 10% on the week. The move is further boosted by a U.S. executive order enabling crypto exposure in $9 trillion worth of 401(k) retirement accounts, which could drive fresh demand. Whales are actively increasing holdings, with ADA climbing from $0.74 to $0.82 before stabilizing near $0.79. On the technical side, ADA has cleared the 0.382 Fibonacci level at $0.62 and is testing the 0.5 level at $0.85. A confirmed breakout could open the path to $1.15 and $1.78 in the coming months. Analysts note the current chart mirrors ADA’s 2020 setup, which preceded a rally to over $3. While the pace of gains is slower this cycle, market sentiment remains optimistic for the Cardano price prediction into late 2025. Remittix: Nearing $20M CEX Reveal with Strong PayFi Vision While ADA builds momentum, Remittix is rapidly emerging as one of the best altcoins to buy now. Its PayFi ecosystem bridges crypto and traditional banking with a strong focus on utility, enabling near-instant transfers in 30+ countries. Users will benefit from real-time FX conversion, low gas fees and support for over 40 cryptocurrencies at launch. Why Remittix Is Generating Buzz Global reach designed for mass retail and business adoption Early token buyers receive exclusive benefits before listings Integrated business API to drive high-volume liquidity Strong grassroots marketing expanding international awareness $18.9M raised, pushing toward the $20M milestone for CEX reveal The upcoming centralized exchange listing announcement is expected to attract a fresh wave of buyers. With the Q3 wallet launch delivering a mobile-first experience and PayFi features, Remittix could see accelerated adoption in the coming months. Utility and Momentum Could Outshine ADA’s Pace The Cardano price prediction remains positive but utility-driven tokens like Remittix may capture investor attention more quickly. Its clear roadmap, innovative PayFi platform and pending CEX reveal give it the potential to rival top altcoins in 2025, making it a project to watch closely. Discover the future of PayFi with Remittix by checking out their project here: Website : https://remittix.io/ Socials : https://linktr.ee/remittix $250,000 Giveaway : https://gleam.io/competitions/nz84L-250000-remittix-giveaway

cryptopolitanabout 4 hours ago

cryptopolitanabout 4 hours ago

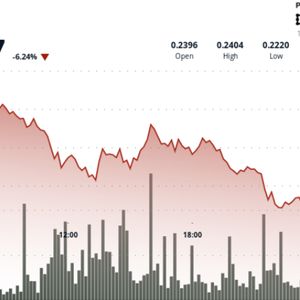

Sharp 7% Drop Sends DOGE Toward 22-Cents Support on High-Volume Selloff

Technical Analysis Overview DOGE falls 6.88% in the 24-hour period ending August 12, dropping from $0.24 to $0.22 as sellers overwhelm bid-side liquidity. The heaviest pressure hits at 07:00 on August 11, with price sliding from $0.238 to $0.233 on 485.69M volume — 31% above the daily average of 371.45M. This establishes $0.238 as a major resistance level. Buyers step in at $0.226 during the 11:00 session, generating 793.38M in volume. Secondary resistance forms at $0.231 as multiple rally attempts fail. Final-hour trade sees DOGE range-bound between $0.2247-$0.2253 with volume compression, suggesting potential seller exhaustion. News Background The selloff comes amid broader weakness in digital assets, with regulatory uncertainty and global trade tensions weighing on risk sentiment. Major economies are escalating tariff disputes, pressuring multinational supply chains, while central banks signal potential policy shifts — a mix that has prompted institutional de-risking across crypto holdings. Price Action Summary • DOGE declines 6.88% from $0.24 to $0.22 in August 11 01:00–August 12 00:00 window • $0.238 resistance locked in after 07:00 selling climax on 485.69M volume • $0.226 support sees 793.38M in buy-side flows; $0.231 secondary resistance caps rebounds • Final hour trades in tight $0.2247-$0.2253 range with falling volume Market Analysis and Economic Factors Whale and institutional profit-taking at $0.238 resistance set the tone for the session, triggering a breakdown below $0.23 and forcing retests of $0.226. Support buying was evident on two major volume spikes (11:00 and 21:00), but repeated rejections near $0.231 kept DOGE pinned. With volume thinning at session lows, the structure hints at possible base-building — though macro headwinds could see $0.22 tested again. Technical Indicators Analysis • Resistance: $0.238 (high-volume rejection), $0.231 (secondary cap) • Support: $0.226 initial defense, $0.2247-$0.2249 intraday floor • 24-hour range: $0.019 (7.89% volatility) • Volume compression near lows signals possible seller fatigue • Multiple failed breakouts above $0.231 confirm supply zone overhead What Traders Are Watching • Retest of $0.22 and whether buyer flows reappear at key support • Breakout attempts above $0.231 as a first step toward recovery • Impact of macro headlines on broader meme coin sentiment • Signs of renewed whale accumulation after selling climax

coindeskabout 4 hours ago

coindeskabout 4 hours ago

[LIVE] Crypto News Today: Latest Updates for August 12, 2025 – Spot ETH ETFs See Record $1B Inflows, BlackRock Leads

Crypto market is flashing a bearish signal today as most sectors pulled back after recent gains. The AI sector led losses with a sharp 7.20% drop, driven by double-digit declines in Virtuals Protocol, ai16z, and Fartcoin. Bitcoin retreated over 2 % to $118,000 after briefly topping $122,000, while Ethereum fell 0.70%, slipping below $4,300. Other sectors, including DeFi and Meme, also saw notable declines, though select tokens like SOON and Pump.fun bucked the trend with double-digit gains. But what else is happening in crypto news today? Follow our up-to-date live coverage below. The post [LIVE] Crypto News Today: Latest Updates for August 12, 2025 – Spot ETH ETFs See Record $1B Inflows, BlackRock Leads appeared first on Cryptonews .

cryptonewsabout 4 hours ago

cryptonewsabout 4 hours ago

XRP Price Flirts With Breakdown—Bulls on the Defensive

XRP price is correcting gains below the $3.25 zone. The price is consolidating and might dip below the $3.080 support zone in the near term. XRP price is struggling to settle above the $3.250 zone. The price is now trading below $3.250 and the 100-hourly Simple Moving Average. There was a break below a key contracting triangle with support at $3.20 on the hourly chart of the XRP/USD pair (data source from Kraken). The pair could start another increase if it stays above the $3.080 zone. XRP Price Approaches Key Support XRP price formed a base above the $2.920 level and started a fresh increase, like Bitcoin and Ethereum . The price gained pace for a move above the $3.20 and $3.25 resistance levels. The bulls pumped the price above the $3.320 level before the bears appeared. A high was formed at $3.380 and the price is now correcting gains. There was a move below the $3.250 level. The price dipped below 23.6% Fib retracement level of the upward move from the $2.90 swing low to the $3.380 high. Besides, there was a break below a key contracting triangle with support at $3.20 on the hourly chart of the XRP/USD pair. The price is now trading below $3.220 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $3.20 level. The first major resistance is near the $3.220 level. A clear move above the $3.220 resistance might send the price toward the $3.2650 resistance. Any more gains might send the price toward the $3.320 resistance or even $3.350 in the near term. The next major hurdle for the bulls might be near the $3.450 zone. More Losses? If XRP fails to clear the $3.220 resistance zone, it could start a fresh decline. Initial support on the downside is near the $3.120 level. The next major support is near the $3.080 level or the 61.8% Fib retracement level of the upward move from the $2.90 swing low to the $3.380 high. If there is a downside break and a close below the $3.080 level, the price might continue to decline toward the $3.020 support. The next major support sits near the $3.00 zone where the bulls might take a stand. Technical Indicators Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone. Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level. Major Support Levels – $3.120 and $3.080. Major Resistance Levels – $3.220 and $3.2650.

newsbtcabout 4 hours ago

newsbtcabout 4 hours ago

Safety Shot Explores Memecoin Treasury Strategy with Bonk Amid Investor Concerns Over Stock Decline

Safety Shot, a wellness drinks maker, has announced a $25 million investment in the Bonk memecoin, leading to a 50% drop in its stock price. Safety Shot’s stock fell over

coinotagabout 4 hours ago

coinotagabout 4 hours ago

Nasdaq-listed firm slumps 50% on BONK memecoin treasury play

Wellness drinks maker Safety Shot has made a bold shift into a memecoin treasury strategy, but shareholders were not impressed.

cointelegraphabout 4 hours ago

cointelegraphabout 4 hours ago

- investing_comcryptonewsabout 4 hours ago

🔥 Hot News

- 1CFTC starts ‘crypto sprint’ with SEC following White House plans

- 2Bitcoin hodlers 'bleed' as Binance daily inflows near 7K BTC

- 3XRP eyes 20% surge in August, crypto returns to US: Hodler’s Digest, July 27 – Aug. 2

- 4GENIUS sets new stablecoin rules but remains vague on foreign issuers

- 5The token is dead, long live the token

- 6How to use ChatGPT Agent for crypto trading in 2025

- 7Small setups, big wins: Is solo Bitcoin mining making a comeback?

- 8China’s crypto liquidation plans reveal its grand strategy

- 9XRP eyes 20% surge in August, crypto returns to US: Hodler’s Digest, July 27 – Aug. 2

- 10Citigroup, JP Morgan, Goldman Sachs lead TradFi's blockchain charge: Ripple